Lots of different groups are chiming in on the US DoT’s plan to not renew antitrust immunity for Delta Air Lines and Aeromexico. Perhaps most surprising among them, however, is the Mexican government. In the past two weeks the Secretariat of Infrastructure, Communications, and Transportation contacted the US embassy in Mexico to deliver a 16 page slide deck, requested a meeting with US authorities, and added a four page summary of the slides as a separate report.

In a filing Undersecretary of Transport Arq. Milardy Douglas Rogelio Jimenez Pons Gomez argues that “the primary obstacles to the DOT extending Antitrust Immunity (ATI) are not related to the airlines.” He further “strongly objects to the DOT’s suggestion that because we have had to take practical measures to address the widely acknowledged congestion at MEX, Mexico is no longer in compliance with its obligations” of the bilateral air services agreement.

Moreover, Gomez states that Mexico “will not look favorable on any unilateral decision by the DOT that has the effect of damaging the commercial situation of Mexican airlines and all those price sensitive passengers that will not benefit from additional capacity between our countries.”

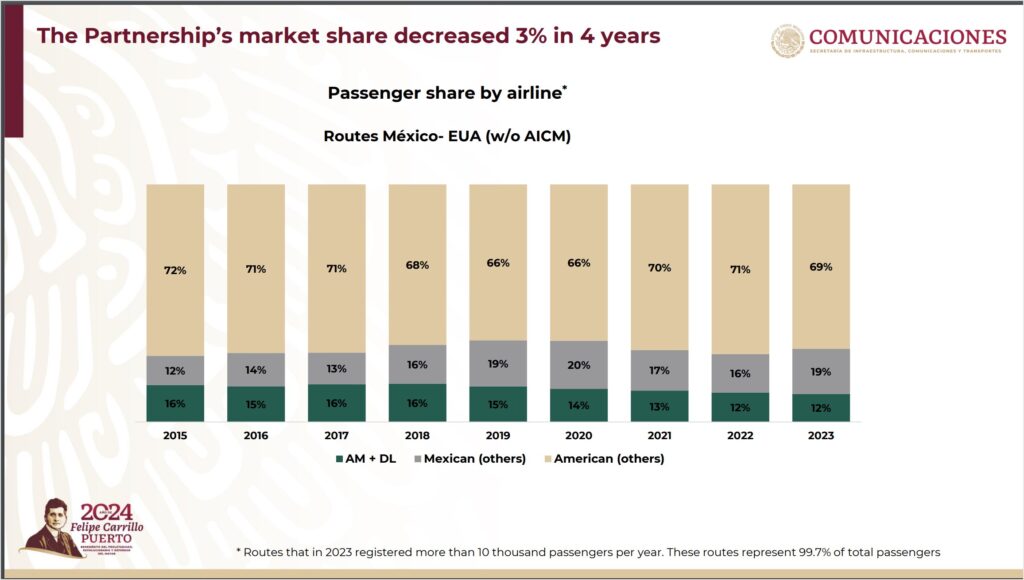

The Government also goes to great lengths to show that when excluding Mexico City, other carriers hold a significantly larger portion of the market relative to the two partners. That share has decreased by 4% since the joint operations launched in 2017. But it does document that their share at MEX increased by more than that.

It is unclear, however, that any of this will sway the DoT’s plans.

Airlines also object

Delta and Aeromexico filed an objection, claiming dozens of routes would be removed or see service reductions as a result. They also argue that the DOT should not punish them as airlines for changes made by the Mexican government, changes the airlines have no role in.

Communities across the United States and Mexico would be directly harmed through the economic and social impacts of reduced and cancelled service between the two countries. Perversely, consumers, not the GOM, would pay the price for the GOM’s alleged infidelity to the Agreement. This is bad policy on the part of the Department and would lead to pernicious consequences for consumers, communities, and competition.

– Delta/Aeromexico filing, objecting to losing their antitrust immunity

Delta and Aeromexico acknowledge the main arguments put forth by the DOT, namely that all cargo carriers were pushed out of Benito Juarez Airport in Mexico City (MEX) and that capacity at that airport was reduced. Much like the Mexican government, however, they do not agree that such cuts constitute a violation of the bilateral agreement.

And even if they are a violation of the bilateral, the airlines would rather see the DoT require Mexican carriers to file schedules for approval, a policy that was implemented for Chinese airlines based on limited access during COVID-19 and which remains in place today. That would still allow the two carriers to maintain their ATI operations, even if Aeromexico’s transborder frequencies were trimmed.

The U/LCC angle

And then there’s Allegiant and VivaAerobus, the pair who have been trying to build a U/LCC transborder joint venture since December 2021. Both these two airlines and the Mexican government note their JV plans have nothing to do with Mexico City. If the DoT’s goal truly is to increase competition in the transborder market, they argue, approving this partnership is a critical step forward.

The Allegiant-Viva alliance has minimal effects in Mexico City but introduces unprecedented new service to Mexico’s leisure destinations. The continued delay of the Allegiant-Viva alliance has had no discernible effect on the pending dispute regarding access at MEX, but prevents the addition of innovative ULCC entry into markets dominated by American, United, and Delta. The prime beneficiaries of DOT inaction are the incumbent legacy airlines and their alliances, while the losers are aspiring travelers who are denied access to the new routes and lower fares the Allegiant-Viva alliance will offer.

Allegiant goes a step further, however, noting that should the DoT allow Delta and Aeromexico to maintain their ATI while further diplomatic negotiations proceed, it should also approve the Allegiant/Viva deal. Failure to do so “would serve only to insulate legacy carriers and legacy alliances from the transformative impact of the low-cost competition Allegiant and Viva seek to provide.”

Similarly, Allegiant argues that terminating the Delta-Aeromexico ATI without approving ULCC version “would yield a similarly anticompetitive result.” Delta and Aeromexico could achieve most of their goals, Allegiant claims, through “without ATI through a combination of codeshare/interline and special prorate agreements due to the relatively straightforward nature of selling airline tickets on largely connecting itineraries.”

The Allegiant/VivaAerobus deal requires ATI, however, to build its leisure packages:

Allegiant will need to assess the latent demand for the target markets and instruct Viva as to routes, schedules, and prices charged to Allegiant passengers, in addition to Viva’s own, for fare, ancillary, and third-party products. Allegiant and Viva will need to negotiate collaboratively with third-party providers to create and price the vacation bundles that will drive much of the traffic. Allegiant and Viva flying will vary considerably by day of the week and week of the year, just like Allegiant’s current network, and require substantial coordination to ensure the correct joint assets are used at the correct time.

Other airlines weigh in

Both American Airlines and JetBlue support the DoT’s position.

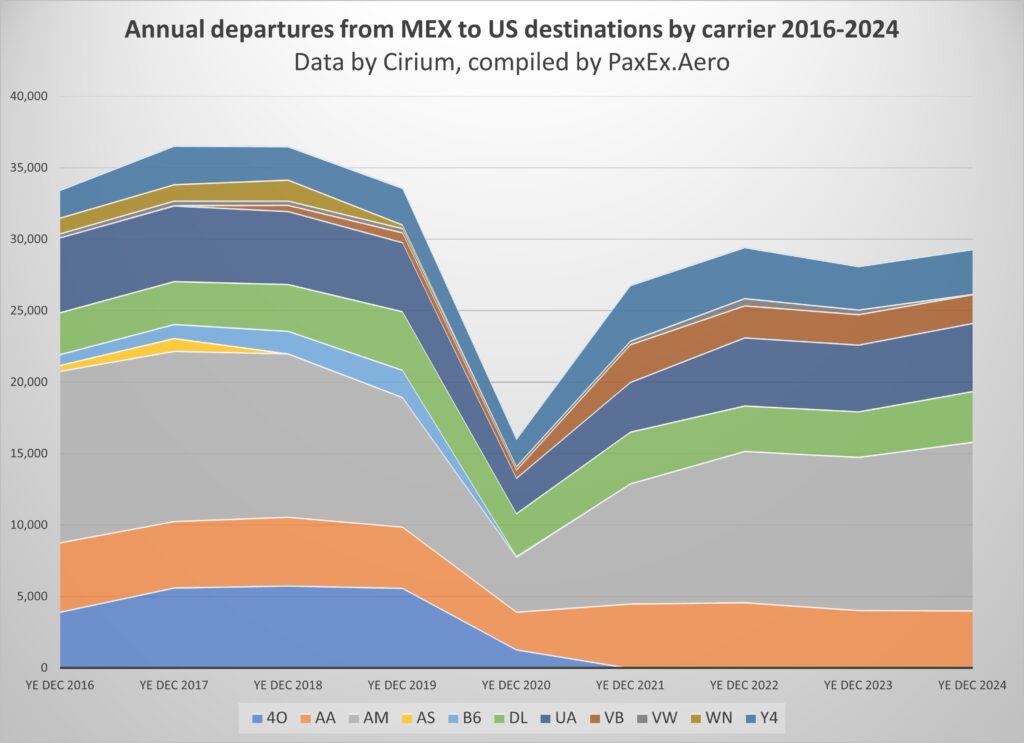

American essentially parrots the DoT’s claims, adding a bit of polish as to why Open Skies agreements are important. But, mostly, it appears the AA filing is meant to ensure its own interests are covered vis a vis other ATI operations elsewhere. Also of note, despite MEX operations being reduced by ~15% in 2022, American is down only ~6% from 2019 levels.

JetBlue, scored slots at MEX as part of the divestiture required for the initial approval. It operated to MEX from 2017, despite less than favorable operating times. It pulled out of the market in early 2020, having never really established a strong foothold. Its position regarding competition parallels the path it argued at Amsterdam last summer:

DOT should not accept the JCA Partners’ contention that DOT can issue de novo grants of ATI in a de jure Open Skies market that is de facto closed to new entry due to the unavailability of slots at key gateway airports. Under this logic, the international aviation landscape would consist only of three U.S. legacy carriers and their immunized joint venture partners, to the exclusion of competition from new entrants and smaller, nonimmunized carriers that cannot enter or grow their market presence due to airport access or other barriers. This is exactly the outcome that Open-Skies was meant to avoid.

Ultimately it secured the Schiphol slots, without US regulatory action. But it should come as no surprise that the carrier is lobbying against the Delta-Aeromexico arrangement.

The objections contain plenty of bold claims, aiming to capture the attention of DoT analysts. But changing the DoT’s mind that the bilateral has been violated, or that the current challenges are not stacked above the competing carriers is a big hill to climb. With the schedule filing approach perhaps the Department could further limit ATI flights at MEX, ensuring other airlines are not penalized in that market for the lack of access. But that creates other problems for the two carriers pushing this position.

As an aside, the Mexican government’s presentation includes a couple mistakes and awkward interpretations of the data. The Canadian airline Sunwing is included in the new routes allocated to US carriers. The government also counts all the US regional carriers independent of their mainline parent operations. While technically correct, those airlines did not launch new routes of their own volition. It also misspells Delta Airlines rather than Air Lines.

A favor to ask while you're here...

Did you enjoy the content? Or learn something useful? Or generally just think this is the type of story you'd like to see more of? Consider supporting the site through a donation (any amount helps). It helps keep me independent and avoiding the credit card schlock.

Leave a Reply