Spirit Airlines will enter a voluntary restructuring, including a prearranged Chapter 11 bankruptcy, to reduce the carrier’s debt while it continues flying. The carrier plans to operate normally during the process.

Passengers can continue to book and fly; all tickets, credits, and loyalty points will be honored. Moreover, the chapter 11 process will not impact employee pay nor benefits. Vendors, aircraft lessors, and holders of secured aircraft debt are also expected to be paid in the ordinary course and will not be impaired.

This set of transactions will materially strengthen our balance sheet and position Spirit for the future while we continue executing on our strategic initiatives to transform our Guest experience, providing new enhanced travel options, greater value and increased flexibility. I’m extremely proud of the Spirit team’s hard work and dedication, which is key to our sustained progress in advancing our business and delivering for our Guests. – Ted Christie, Spirit’s President and Chief Executive Officer

Existing bondholders are providing a $350 million equity investment, plus $300 million of Debtor-in-Possession financing. Those funds, combined with the carrier’s existing liquidity, are expected to be sufficient to continue operations through the restructuring process and beyond.

The bankruptcy filing indicated both assets and debt in the $1-10 billion range. The most pressing part of that, however, are the Notes due in 2025 and 2026. Under the announced deal, some $795 million of of that debt will be equitized, while the existing publicly traded shares will be delisted from trading and eventually cancelled. Those shareholders will no longer have any equity in the company as a result of the transaction.

Spirit says the planned deal is supported by a supermajority of its loyalty and convertible bondholders. It expects to emerge from the prepackaged chapter 11 process in the first quarter of 2025.

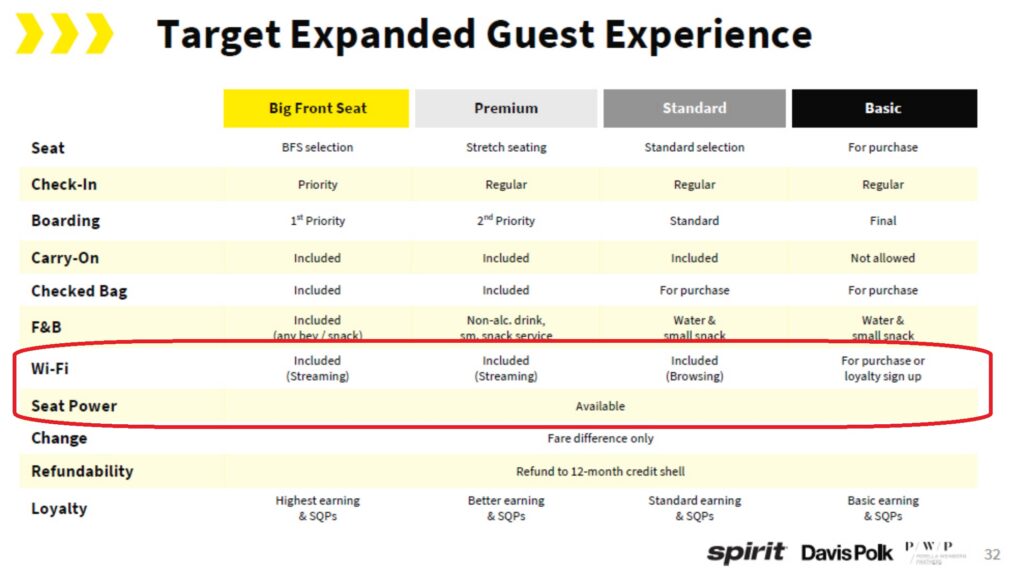

Spirit aims to continue the realignment of its service offering, including the new fare families and on-board amenities. While the carrier is optimistic about the potential for those plans to boost revenue, they also come with a short-term hit, particularly as most change and cancel fees were eliminated.

From a customer-facing perspective, Spirit’s rebuilt offerings are expected to go beyond the already announced fare families and seating changes. Notably, the carrier’s “Project Bravo” includes mention of in-seat power and complimentary Wi-Fi for passengers on board.

The Wi-Fi shift, in particular, would be a significant move for the carrier. The existing system, deployed in partnership with Thales, was initially selected because the provider took on the brunt of the costs and kept the bulk of the generated revenue. Eliminating the revenue side of things (or most of that, with some incremental income from passengers upgrading to Streaming plans) would likely require substantial changes (ie costs to Spirit).

Similarly, installing power on board is not free. It is, however, more of a one-time CapEx than ongoing OpEx.

The case is filed in the US Bankruptcy Court for the Southern District of New York as Bankruptcy Petition #: 24-11988-shl.

A favor to ask while you're here...

Did you enjoy the content? Or learn something useful? Or generally just think this is the type of story you'd like to see more of? Consider supporting the site through a donation (any amount helps). It helps keep me independent and avoiding the credit card schlock.

Leave a Reply