Operating a pair of hubs less than 200 miles apart can be incredibly challenging for airlines. As it absorbs the Hawaiian Airlines operations Alaska Airlines is making substantial changes to its network, affecting how its Seattle and Portland hubs function and the roles they will play for the carrier moving forward.

Seattle is, of course, the keystone of the airline’s operations. It is the largest hub on the west coast*, offering more connecting seats across North America and more nonstop destinations than the competition. But it is also incredibly strong for origin & destination services. Even as the carrier introduces long-haul international services at Seattle, routes that will benefit from domestic feed, it is also shifting a significant chunk of typical “hub” operations to the south, allowing Portland to absorb more connecting traffic.

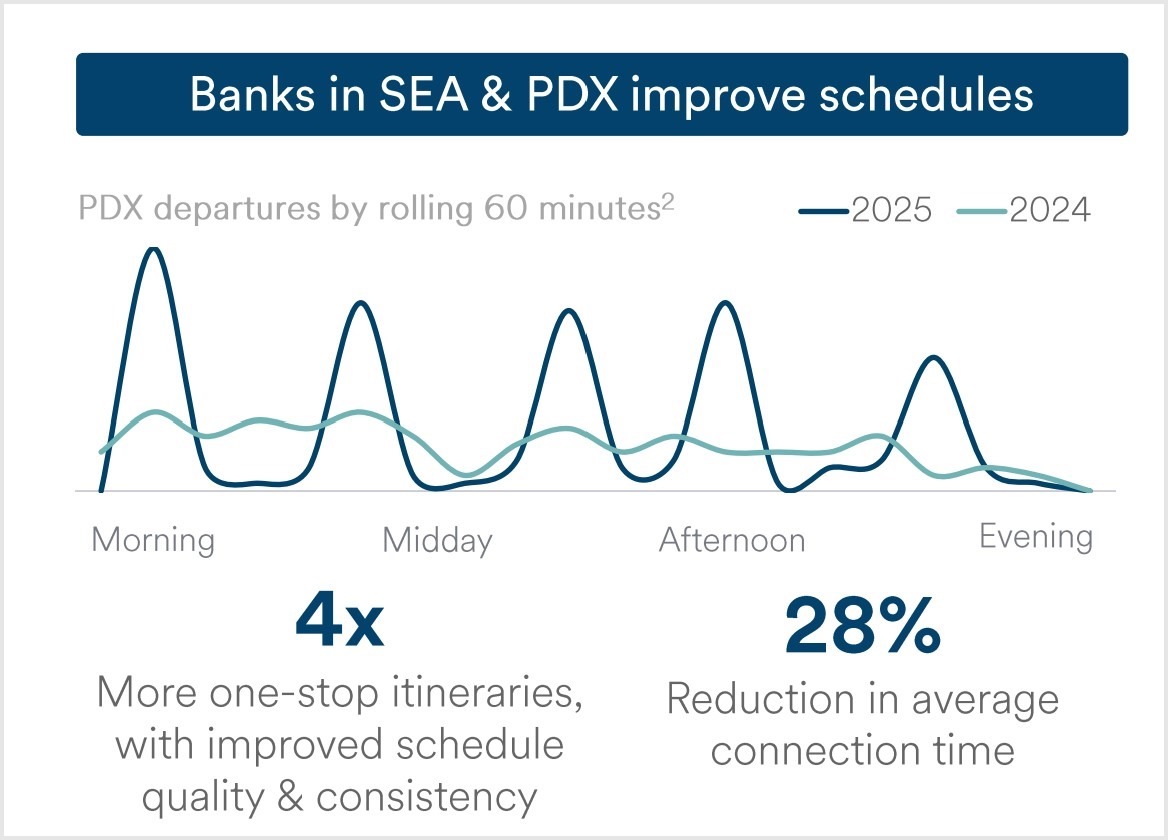

Building Banks

By Summer 2025 Portland will shift from a rolling flow to banked operations, with five peak connection times. It comes five years later than initially planned, CCO Andrew Harrison explained at the carrier’s recent investor day:

We were getting ready, just prior to the pandemic, to really bank Portland… Our volumes got to a place where it was time to bank, and then the pandemic hit. We let it go. So now, with the number of O&Ds we serve with the congestion in Seattle, creating five specifically defined banks… We think that’s going to be very powerful.

CEO Ben Minicucci was perhaps even more bullish on the value of Portland as a connecting hub:

Portland is a perfect connect point for a lot of domestic connections that we run through Seattle today. As we can get more folks going through Portland – it is a brand new airport, we’re gonna have a brand new lounge there, we are the number one carrier there – it will help us on connect times and operations.

The value continues from there, as larger aircraft show up in Seattle. Minicucci continued, “We can now take the high value flow that wants to go to, initially Asia and ultimately Europe, and reopen ourselves [at Seattle] for local traffic that we’re probably spilling today.”

This approach is similar to how United Airlines manages flow at its Newark and Washington-Dulles hubs and how American Airlines deals with its network at JFK and Philadelphia. It is not perfect, but it allows the airlines to capture more of the high-revenue traffic who want to be in the larger city (Seattle, NYC) while pushing connections to the overflow/relief airport (Portland, Philadelphia, Dulles), but with similar geographic value for flight routes.

Alaska Airlines also hinted at a similar effect between its Los Angeles and San Diego operations, though that is a longer-term project, not something coming in 2025.

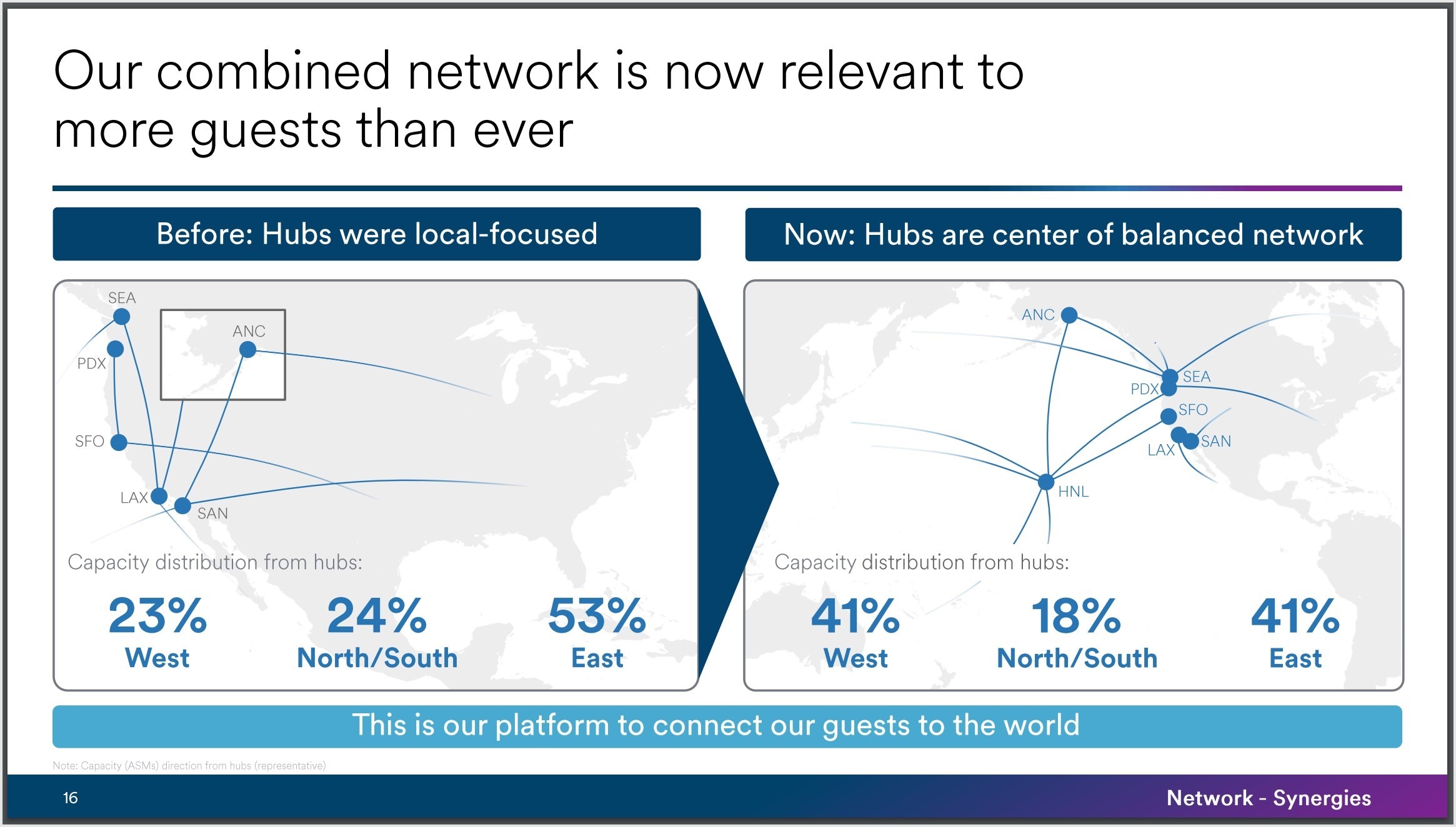

A different take on hub positioning

Making hubs work means having them well positioned to move passengers across the network. Typically that means an airline does not want a hub in the corner of its route map. Like, say, in the northwest corner of the United States when handling passengers mostly moving through the Lower 48. The carrier is now optimistic that the combined operations, including a hub in Honolulu, significantly shifts that story.

Alaska Airlines did not publish how it got to these numbers, and my efforts to reproduce them differ slightly. But it is clear that the additional capacity from Honolulu significantly shifts the center of the carrier’s operations. What is less clear is if the traffic is balanced, able to take advantage of passenger flows with the new arrangement.

Perhaps it is enough that the aircraft will flow more efficiently through the network. A redeye from the islands to the mainland could, for example, be more efficiently used by continuing east or north/south, rather than simply returning to Hawai’i, even if passengers are not connecting through. And some of those passengers will, which also helps.

But there is more to hub efficacy than geography. People and planes need to move smoothly through those hubs.

Moreover, the theoretical aircraft efficiency is countered by the carrier’s plan to operate all flights to, from, and within Hawai’i under the Hawaiian branding. If the planes never make it past the west coast are they being used in their most efficient manner?

As Alaska’s international network continues to expand at Seattle it will need to balance connecting feed with the local traffic. And, unlike the larger competitors noted above, it is unlikely to achieve the scale where both Seattle and Portland are able to support significant long-haul operations, at least not in the next several years. But it can probably get Seattle into a strong position with the available feed. And more efficient aircraft flow might follow.

*This excludes United’s robust Asia and Oceania operations, but it is an Alaska Airlines presentation so of course they’re going to pick a version of the data that skews in their favor.

More from Alaska Airlines’ Investor Day:

- Alaska Airlines’ plan to juice revenues to the islands

- Premium cabins are the future: Alaska Airlines Edition

- Alaska Airlines launches long-haul hub at Seattle, pushes premium

- Alaska Airlines receives DOT approval for Hawaiian acquisition

A favor to ask while you're here...

Did you enjoy the content? Or learn something useful? Or generally just think this is the type of story you'd like to see more of? Consider supporting the site through a donation (any amount helps). It helps keep me independent and avoiding the credit card schlock.

Leave a Reply