A feeding frenzy is afoot as airlines seek access to newly approved slots at Washington, DC’s Reagan National Airport. For the first time in years Congress approved the addition of flights at DCA, and these five new flights are special: they allow airlines to fly beyond the 1,250 mile limit typically imposed on the airport’s operations.

The business cases being made by the airlines are balanced with political maneuvering, as some airlines disagree with the Department of Transportation’s interpretation of certain definitions of who can even choose to apply, adding another layer of complexity and uncertainty to the proceedings.

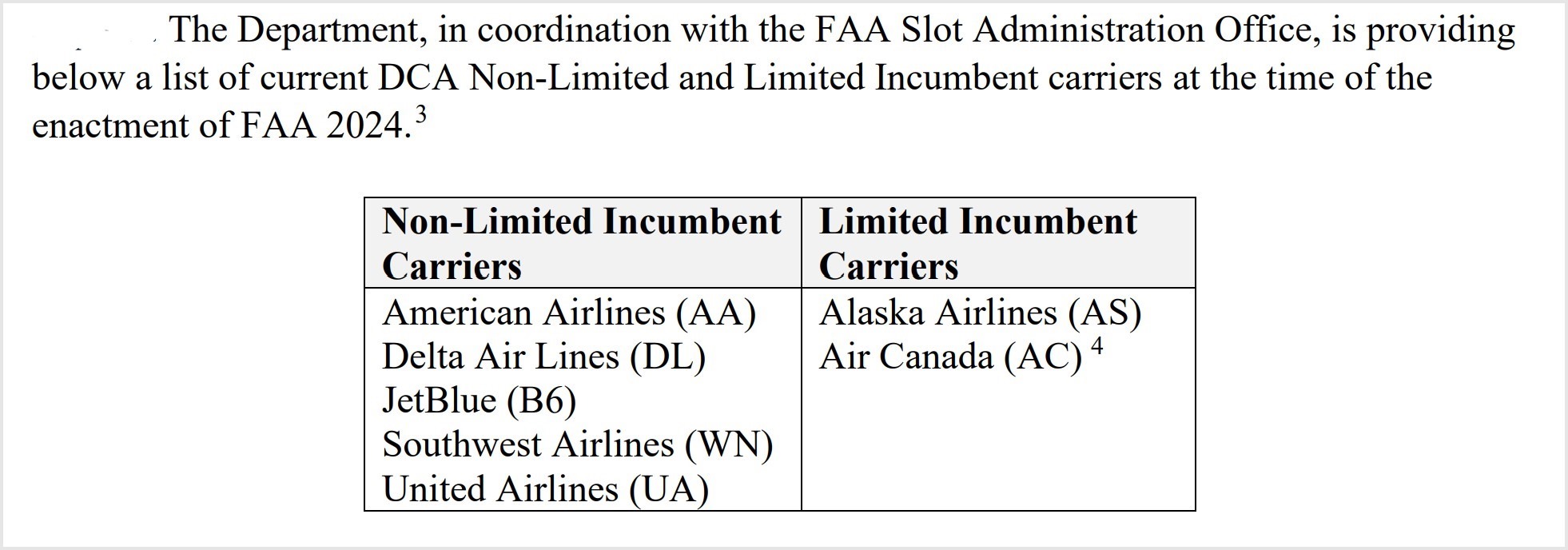

Four of five new flights are, by Congressional mandate, to be issued to “incumbent air carriers qualifying for status as a non-limited incumbent carrier” while the remaining flight is to be allocated to “a limited incumbent carrier.” The FAA subsequently reviewed the definitions of those terms and produced a list of which airlines qualify for each category:

Those definitions, however, are opposed by Spirit and Frontier.

What is a Limited Incumbent Carrier?

Two other airlines have also made a pitch to be included in slot allocation process, each depending on nuanced legal phrasing to make their claim.

Spirit Airlines says the fact that it was allocated slots in 2003 makes it an incumbent, even though it sold those slots to Southwest. Under that claim, and despite not operating to DCA today, the carrier pitches service to San Jose, California on an A320neo. The carrier teases onward connections at SJC in its application, though almost no such options exist with the current published flight times per November’s schedule.

Similarly, in Frontier Airlines‘ application to serve San Juan, the carrier claims limited incumbent status based on its current thrice daily service to Denver. While all three of those slot pairs are considered exemption slots, which do not count towards the total operated at DCA per the laws, Frontier argues that there is no minimum number stated in the law, and its existing operations prove it is an incumbent. So with zero regular slots allocated – less than the 12 cutoff in the regulations – it is a limited incumbent.

Both Spirit and Frontier also argue that Alaska Airlines is ineligible as a limited incumbent owing to its codeshare agreement with American Airlines. Not surprisingly, Alaska Airlines disputes that, as being the only limited incumbent increases its odds of securing its requested slot.

Finally, Breeze Airways filed into the docket, objecting to the exclusion of new entrant carriers from consideration for the new slots. That’s a congressional issue, not an administrative one, but the carrier put its position on file.

The listed airlines made clear their intentions early on, and in their official filings there were few surprises:

- American Airlines seeks to add service to San Antonio, with flights operated on an A321.

- Delta Air Lines seeks to add service to Seattle, with flights operated by an A321neo.

- JetBlue seeks to add service to San Juan, with flights operated by an A321/A321neo.

- Southwest Airlines seeks to add service to Las Vegas on a 737.

- United Airlines seeks to add service to San Francisco on a 737 MAX 8.

- Alaska Airlines seeks to add service to San Diego on a 737.

Map generated by the Great Circle Mapper - copyright © Karl L. Swartz.

The applications include minor bits of sniping by the airlines at their competitors. American, for example, points out that United and Southwest, who currently operate the alternative routes from San Antonio to the DC area each have those markets as some of the most expensive from the Texas city. Delta similarly argues that Alaska Airlines needs a competitive force to bring down fares.

In a somewhat unexpected move, JetBlue also argues that its application will reduce the fares it charges. The carrier claims it will lower its own existing fares by 30% if it is allowed to double its capacity in the San Juan market, insisting demand is simply too high for it to otherwise reduce ticket prices.

Questionable Connections

The legislation authorizing the service instructs the Secretary of Transportation to:

consider the extent to which the exemptions will—

(i) enhance options for nonstop travel to beyond-perimeter airports that do not have nonstop service from Ronald Reagan Washington National Airport as of the date of enactment of the FAA Reauthorization Act of 2024; or

(ii) have a positive impact on the overall level of competition in the markets that will be served as a result of those exemptions.

While Congress emphasizes new nonstop markets being served, the airline applications also offer some interesting suggestions on connections that may be of value to travelers in an effort to tip the scales in their favor.

Spirit, for example, pitches onward connections at San Jose. Alas, none of its currently filed flights for the 2024 winter season at SJC offer connections eastbound; only LAX is available as a connection westbound.

Similarly, Alaska Airlines teases onward connections to Hawaii. The currently published schedules do not offer any connections from DCA to Hawaii without an overnight on the west coast. Eastbound there are some redeye options seasonally which could potentially work.

So, who wins?

If the DOT focuses, as mandated by the legislation, on new markets as a priority, American and Alaska are winners. Spirit would be as well, if the Department is convinced of the carrier’s eligibility, though that would also depend on Alaska being bumped up to the non-limited incumbent category. If Alaska remains a limited incumbent it is likely to secure the only slot pair available for that classification.

After those three, the remaining proposals are all existing routes seeking additional frequencies. And only non-limited incumbents are in play. This would likely leave Frontier empty-handed in the allocation cycle.

Delta and Southwest each propose competition against another airline, boosting the “overall level of competition in the markets” and suggesting they’re more likely winners of the remaining two slot pairs available.

If Alaska Airlines remains classified as a limited incumbent then either United or JetBlue would receive the remaining non-limited route. I tend to slightly favor JetBlue, as its appeal to the DOT to undue damage caused by the DOJ is an interesting angle.

The full docket, including all the applications and letters of support, can be found here.

A favor to ask while you're here...

Did you enjoy the content? Or learn something useful? Or generally just think this is the type of story you'd like to see more of? Consider supporting the site through a donation (any amount helps). It helps keep me independent and avoiding the credit card schlock.

Leave a Reply