Nothing says an aviation market has arrived like the publication of a 20-year Market Outlook whitepaper alongside the annual summer airshow season. And so it is that Eve, the Urban Air Mobility offshoot of Embraer, issued its first ever outlook for the UAM segment, released in advance of the 2025 Paris Air Show.

[D]ue to high operational costs, high noise profiles, and other factors, only a small portion of the population has had access to that mode of transportation. UAM has indeed been a reality, but only for a few.

– Embraer UAM Market Outlook

That is about to change.

No doubt urban populations are set to dramatically in the decades ahead. Eve cites statistics anticipating a global population growth from the current 8.1 billion to 9.7 billion by 2050. Today 4.6 billion people live in urban environments; that is forecast to reach 6.7 billion by 2050. Today 2.1 billion people live in cities with a population greater than 1 million; that number is expected to be 2.6 billion by 2035.

And with that population density Eve expects UAM to become a significant part of the transportation landscape. Riding on the hockey stick growth of EV sales momentum, Eve sees a similar path for UAMs. The company forecasts 30,000 in service globally by 2045. By contrast, Boeing also released its Commercial Outlook document for 2025 over the weekend, anticipating 43,600 deliveries; Airbus similarly predicts 43,420.

Presumably the lifespan of the eVTOL UAMs will be less than 20 year. And for the first generation that number is likely to be significantly lower. This means getting to a steady state of 30,000 in operation by 2045 will likely require producing more than either Airbus or Boeing forecast for traditional aircraft.

Also notable in the forecast: Eve expects 3 billion total passengers in UAMs over the next 20 years (roughly equal to Tokyo’s annual subway ridership today), generating passenger revenues of $280 billion. That averages out to just over $93/ride. That number is absurd for a technology pitched as democratizing transportation and becoming part of the mass transit ecosystem. On the flip side, however, it is a bargain when seen as a like-for-like replacement of helicopter transfers in most urban use cases today.

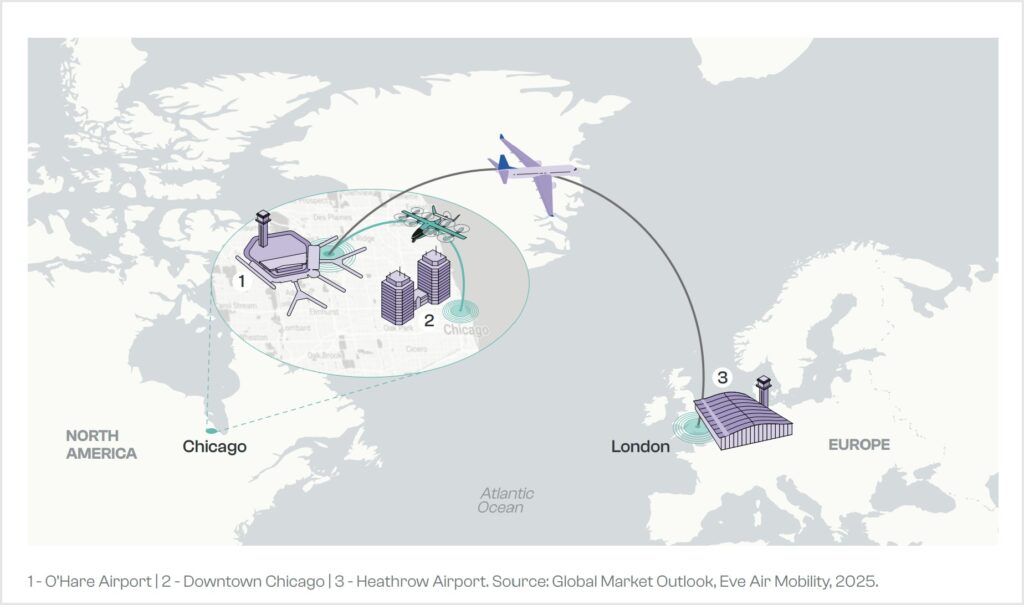

In 2022 Eve conducted a “comprehensive UAM simulation” in Chicago, flying helicopters to evaluate what a modern eVTOL operation could deliver. Among the key data points was an average turn time of 12 minutes per aircraft, assuming 65% average loads on board. Figuring a 10-15 minute flight as well and each vehicle can operate 2-3 trips per hour. The promised efficiency of UAM services comes from travelers not needing to wait for a ride. These numbers – and they assume mature, optimal operations – suggest it will be quite some time before that’s a real likelihood at scale.

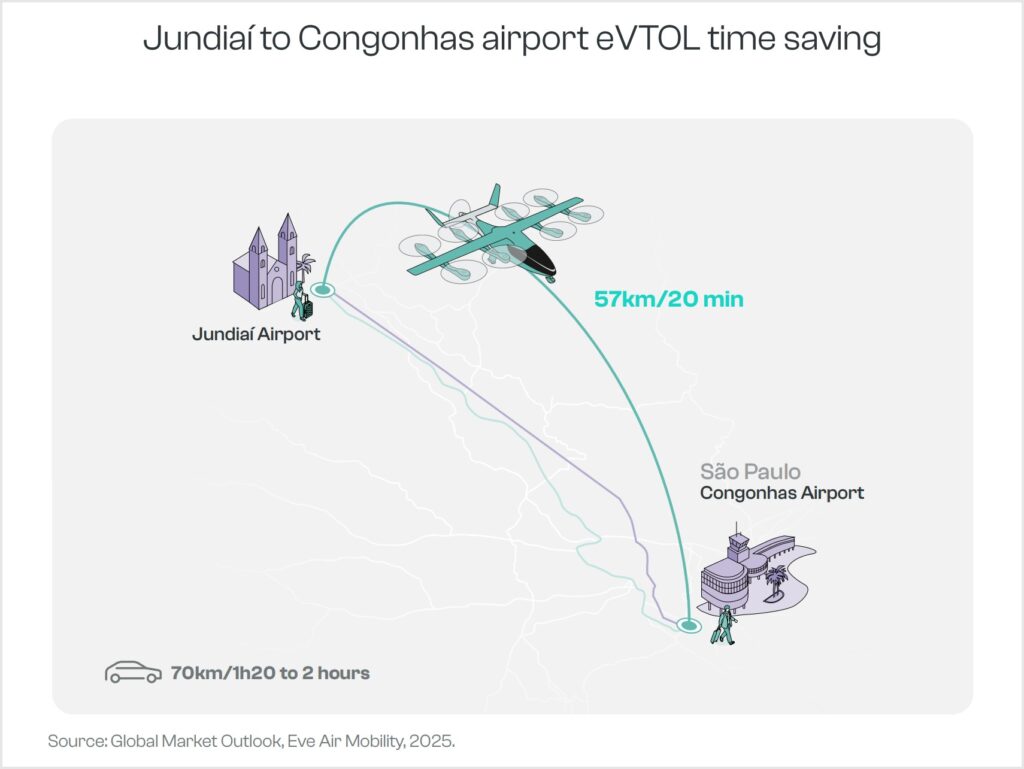

In South America Eve shares that “citizens spend almost 222 extra hours a year driving during rush hour in São Paulo, a metropolitan city with a population of 22 million people. Dozens of cities near the capital of São Paulo serve as housing zones for workers. A trip on an eVTOL from Jundiaí to São Paulo could save 60 minutes in commuting.”

This number does not take into account the commuter getting to Jundiaí to catch the ride. And even if it did, the vast majority of those commuting in to work will not be able to afford a ride at the anticipated average price. Even discounted ~90%, a $20 daily commute is out of reach for many.

The good news, perhaps, is that there won’t be too many seats for those commuters to ride in anyways. With a 20 minute trip time and 12 minute turn each eVTOL can effectively run one round-trip per hour.

São Paulo sees 400+ helicopters operating today, with a total of 2,000 daily departures. Even if all of them focused on this one route that’s still fewer than 2,000 hourly commuters each direction, and a decidedly asymmetrical demand profile. On the plus side, Eve confirmed a “binding framework agreement” for 50 aircraft in the market, with deliveries to Revo coming from Q4 2027.*

n.b. – The above paragraph was updated to reflect more accurate (higher) numbers of urban air traffic in the region than initially included in the analysis.

Eve also pitches a 19 minute hop between Pretoria and Johannesburg, besting the 90 minutes driving. Of course, there’s already Gautrain, making the trip in 35 minutes with the fare a fraction of what a UAM trip is projected to cost.

Chicago is also pitched as a time-saver for long-haul travelers. With a projected incremental cost of 3-5% of the overall trip, Eve expects travelers will flock to a eVTOL transfer from downtown to O’Hare. As with the South Africa example, the existing mass transit offering will likely continue to carry massively more travelers at a fraction of the cost. Also, it does not account for the needed transfer to the airport terminal nor the (admittedly shorter) last mile in town.

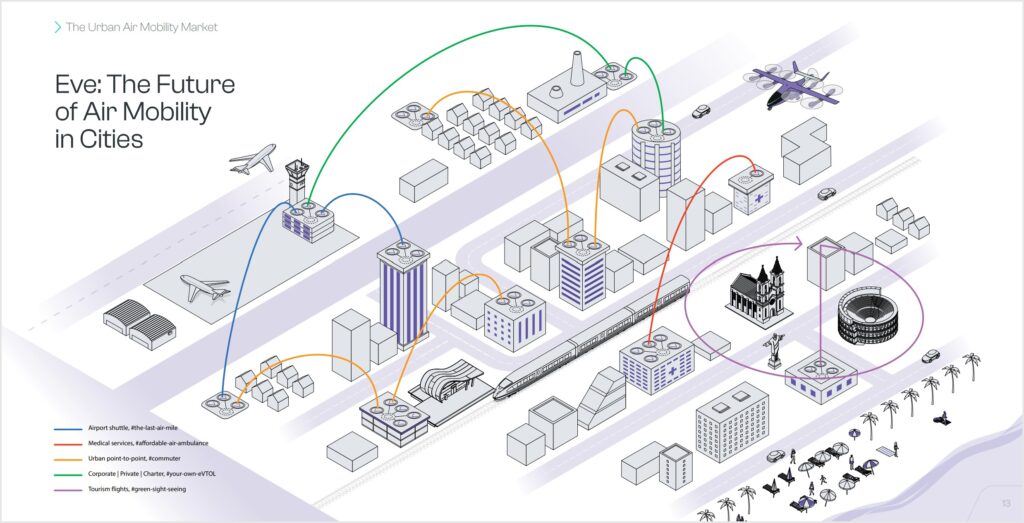

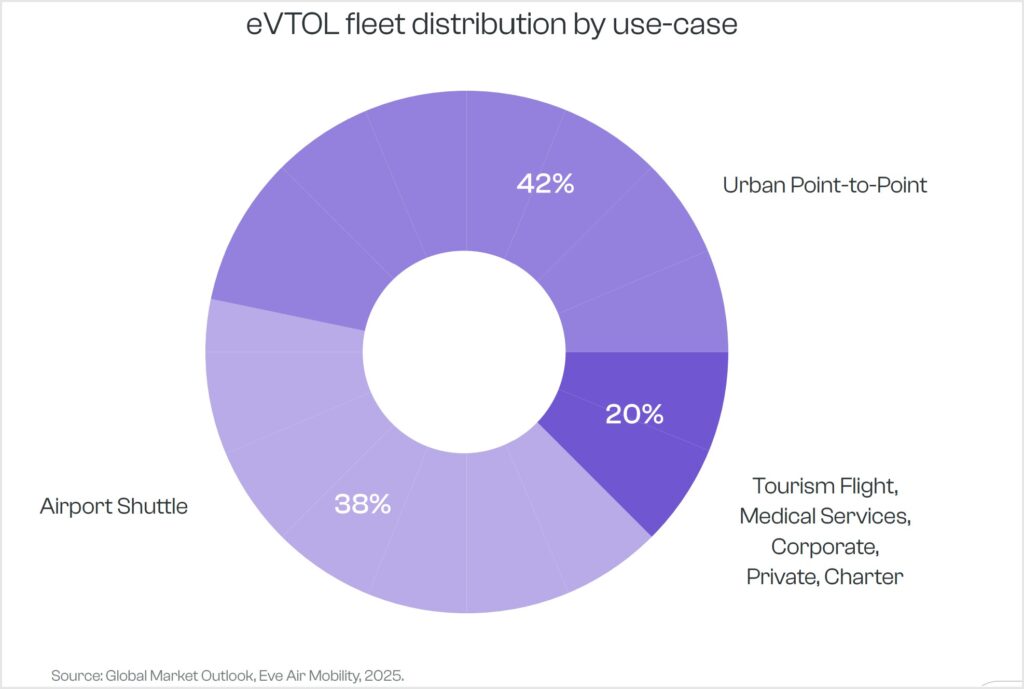

Eve is not alone in predicting mass demand for urban airport connections (38% of the total). Competitor Archer Aviation scored the backing of United Airlines and Southwest Airlines and sees networks in the San Francisco Bay Area and New York City and Los Angeles. Joby, with backing from Delta Air Lines and Virgin Atlantic, published an eVTOL dream map for the UK last year.

It is likely the average price per ride will be higher to start, dropping over time. Perhaps by 2045 that means hundreds of millions of travelers will be flying for ~$50/trip rather than ~$90 (though I’m also not sure how inflation factors into the revenue forecast). That will help demand grow.

But I remain stuck on the fact that these vehicles serve mostly asymmetric demand, with a limited route network, and significant development and operating costs. They are decidedly not a replacement for effective mass transit, and any urban area keen to address the challenge of time lost to commuting must first focus on other options. UAM will serve just a tiny fraction of demand and should be approached from that perspective, not as the panacea of urban transit.

*As a side note, Revo and its parent OHI currently operate “a door-to-door mobility solution, integrating car and luggage services with scheduled helicopter service connecting key locations in southeast Brazil.” The company says the Eve aircraft will make part of the operation “fully electric and sustainable” though that seems to ignore the limited luggage capacity on eVTOL aircraft, meaning the road traffic might remain to move bags.

More news from the 2025 Paris Air Show

- Eve Projects Three Billion eVTOL Riders Over 20 Years

- Safran, Greenerwave Team for Metasurfaces ESA Development

- "THE Room FX" Brings Business Class Update to ANA’s 787s

- Qatar Airways Pivots to PAC’s Converix, Astrova for 777X Digital Experience

- JSX Pitches Premium Turboprop Play

A favor to ask while you're here...

Did you enjoy the content? Or learn something useful? Or generally just think this is the type of story you'd like to see more of? Consider supporting the site through a donation (any amount helps). It helps keep me independent and avoiding the credit card schlock.

Leave a Reply