SES will acquire Intelsat in a $3.1 billion transaction, continuing the consolidation trend in the satellite provider space. Not surprisingly, the mobility segment plays a significant role in driving the value of the deal.

In a fast-moving and competitive satellite communication industry, this transaction expands our multi-orbit space network, spectrum portfolio, ground infrastructure around the world, go-to-market capabilities, managed service solutions, and financial profile. I am excited by the opportunity to bring together our two companies and augment SES’s own knowledge base with the added experience, expertise, and customer focus of the Intelsat colleagues.

– Adel Al-Saleh, CEO of SES

In the presentation to investors SES CEO Adel Al-Saleh emphasized multi-orbit capabilities and the ability to further scale up capacity as key to driving further profit growth. And, more than just putting capacity into orbit, Al-Saleh focused on the deliver of end-to-end managed services, both in the commercial mobility and government verticals, as critical growth markets for success.

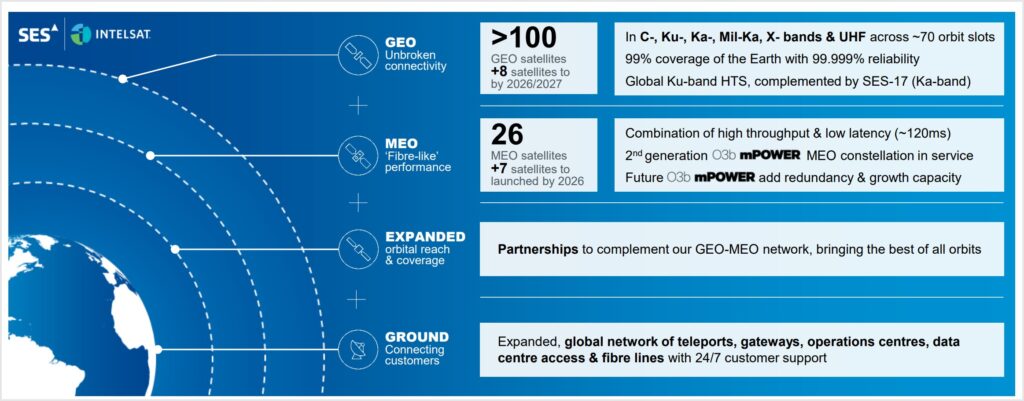

To that end, Intelsat’s collection of GEO satellites will join the GEO and MEO constellations of SES to boost global capacity. Moreover, the well-developed inflight connectivity arm of Intelsat (formerly Gogo‘s commercial aviation business) will combine with SES’s cruise business to scale up in the mobility segment, supporting integration of the managed services front.

SES also offers an inflight connectivity solution, notably as an Airbus HBCplus partner. It is not, however, particularly popular in the commercial aero market today. That could change with Intelsat’s IFC sales team joining the fray.

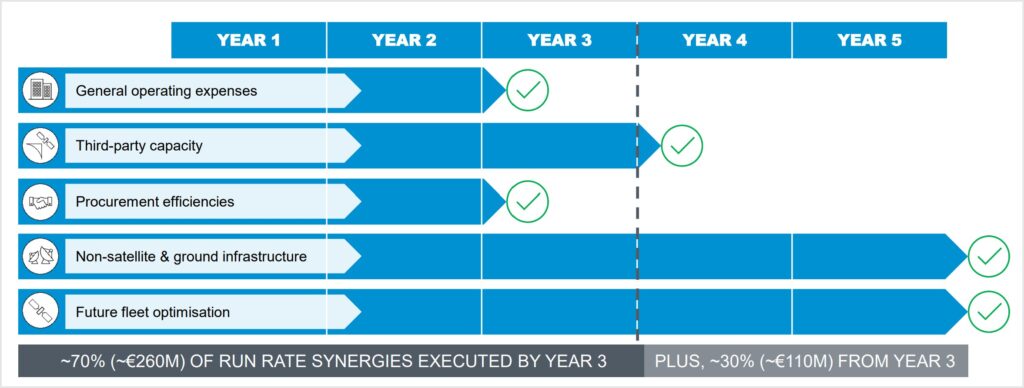

The company should be able to align its sales operations relatively quickly. Optimizing the in-orbit fleet, however, will likely take a bit longer. The company projects a five-year horizon for that to come together, based largely on existing satellite manufacture and launch plans continuing to play out. This includes the O3b mPOWER MEO satellites continuing to launch, as well as SES-26 in GEO orbit.

Speaking to the deal Intelsat CEO David Wajsgras notes that the recent Chapter 11-supported reorganization saw the company “reverse a 10-year negative trend to return to growth, establish a new and game-changing technology roadmap, and focus on productivity and execution to deliver competitive capabilities.” That made Intelsat an attractive buy-out target, and SES has the balance sheet to make that happen.

Wajsgras continues, “By combining our financial strength and world-class team with that of SES, we create a more competitive, growth-oriented solutions provider in an industry going through disruptive change. The combined company will be positioned to meet customers’ needs around the world and exceed their expectations.”

The transaction is subject to relevant regulatory clearances/filings and customary provisions concerning cooperation and measures in seeking such regulatory clearances, which are expected to be received during the second half of 2025.

A favor to ask while you're here...

Did you enjoy the content? Or learn something useful? Or generally just think this is the type of story you'd like to see more of? Consider supporting the site through a donation (any amount helps). It helps keep me independent and avoiding the credit card schlock.

Leave a Reply