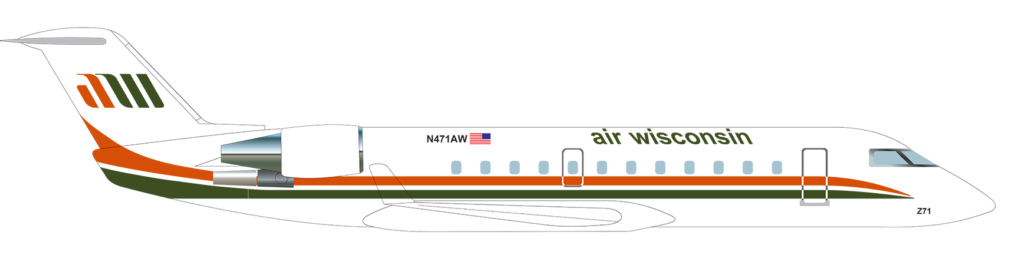

Air Wisconsin is getting out of the regional affiliate business. The carrier, which operates a few dozen CRJ-200 aircraft under the American Eagle brand, will transition to focus on charter and Essential Air Service operations from April 2025.

This strategic shift underscores our adaptability and commitment to delivering reliable, customized air travel solutions where they are most needed. As we diversify into EAS and grow our charter operations, we remain committed to delivering safe, efficient, and quality service to every community and customer we serve. – Robert Binns, President & CEO of Air Wisconsin

The move will affect 47 markets served under a capacity purchase agreement partnership today. And arguably in a good way.

Map generated by the Great Circle Mapper - copyright © Karl L. Swartz.

Of the markets only one loses any frequencies – ORD-ATW goes from 4x daily to 3x. It does so, however, without losing any seats, as the three remaining flights upgrade to larger regional jets.

Capacity is mostly being backfilled by Piedmont and Envoy, both wholly-owned subsidiaries of American Airlines. Piedmont operates 50-seat ERJ-145s, generally a more comfortable experience on board than the CRJ200s. Envoy operates the ERJ170/175 family. Envoy’s presence will bring first class seats into 11 of the markets where it was not previously offered.

Map generated by the Great Circle Mapper - copyright © Karl L. Swartz.

The transition to larger regional jets also means adding inflight internet to the routes. American’s 70-seat RJ fleet is in early stages of a refresh to bring faster, satellite-based connectivity to those planes.

Air Wisconsin is, unsurprisingly, spinning the news as positive.

Sports charter opportunities are notable for the carrier. It cites the realignment of NCAA conferences as a driving factor, as that “has increased travel distances for teams, both during their regular season and post-season tournaments.” Breeze has also tapped into that market with its larger ERJ190 aircraft now that it has its A220 fleet for scheduled service.

Air Wisconsin says it is also focused on the opportunity to “deliver vital air connectivity to rural and underserved communities” in the EAS market. It will bring larger planes as an option, but must also compete where smaller operators are certified under Part 135 rules rather than Part 121. Part 135 comes with generally lower operating costs, a challenge that SkyWest tried to work around by launching a new subsidiary. That plan has not yet been blessed by the Department of Transportation. While EAS communities may prefer jet aircraft and larger planes, the higher operating costs translate to higher subsidy requirements from the feds. That could limit the scope of EAS markets that can be captured.

At least Air Wisconsin owns its planes outright. The lack of debt helps a bit on the cost side to keep things competitive.

A favor to ask while you're here...

Did you enjoy the content? Or learn something useful? Or generally just think this is the type of story you'd like to see more of? Consider supporting the site through a donation (any amount helps). It helps keep me independent and avoiding the credit card schlock.

Leave a Reply