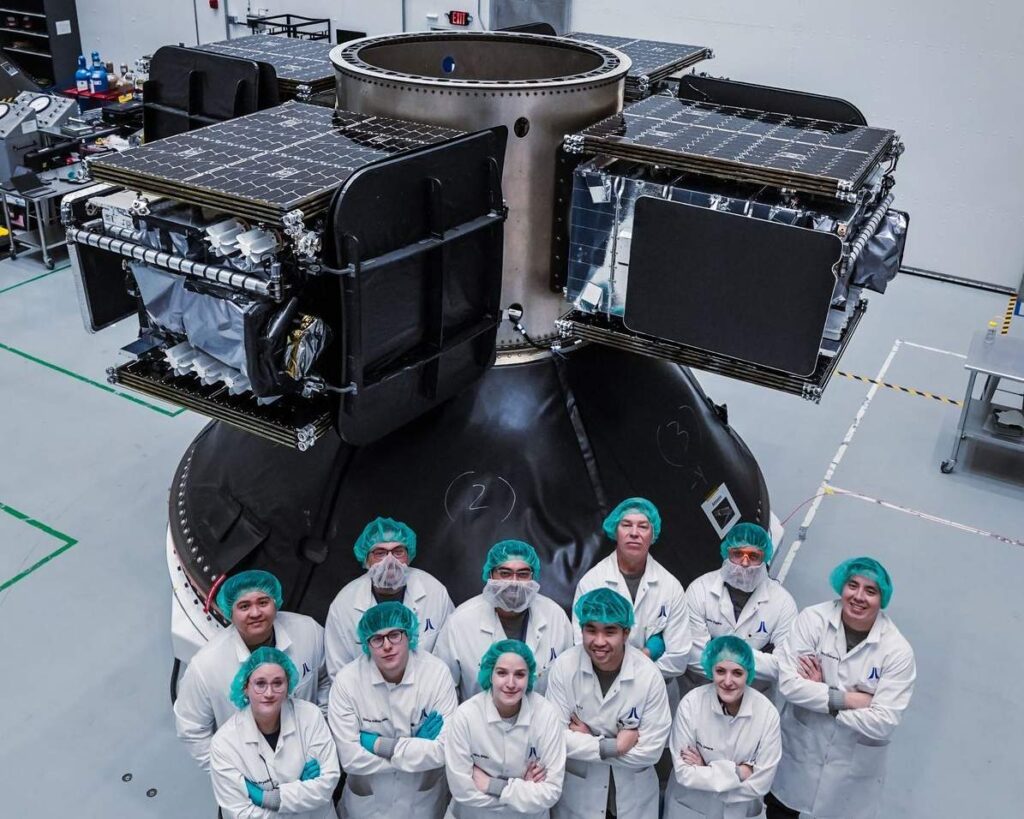

Anuvu‘s inflight internet customers now have access to 50 Gbps of additional capacity over the United States, thanks to NuView-A and NuView-B, microGEO satellites from Astranis. The satellites launched at the end of 2024 and, after orbit raising and testing, are now in service. Anuvu confirms that the satellites entered service and are “currently supporting aero customers.”

Enablement of the Astranis capacity comes just over four years after the Anuvu deal was announced, and more than five years after Anuvu CEO Josh Marks tipped that the company was pursuing the concept. During that conversation, in January 2020, Marks explained:

One of the advantages of small sat design is you can cluster a number of different satellites in the same slot. And if you think of a small satellite like a Lego brick, you can brick your way to coverage map that’s complimentary and effectively simulate the high throughput satellite beam structure at a much lower cost.

While it has taken some time to get here, Anuvu has held to that view throughout the process.

Moreover, the company also sees these microGEO satellites as a “bridge” to the next generation of connectivity. That’s part of how they justify the shorter expected lifespan relative to larger GEO satellites. EVP Connectivity Mike Pigott believes the microGEO satellites, and that evolving strategy, “enable flexible connectivity architectures that allow clients to pivot their business model as new technology is deployed.” This also includes eventually getting LEO capacity into the mix – though not exclusively LEO services – as the Lightspeed constellation from Telesat comes online.

Marks has previously spoken strongly against the “owner economics” argument of more vertically integrated satcom operations, suggesting that leasing capacity – and in particular the ability to secure relatively short-term leases – offers his company a cost and flexibility advantage.

But this is not the first time the company has had control of the full capacity of a satellite. When it operated as Global Eagle it acquired the full capacity of AMC3, which it rebranded as Eagle-1. It also bought out the full capacity of Eutelsat 139WA, which was previously Eutelsat 7A before being repositioned to support Anuvu’s needs over North America. And now, with the Astranis capacity in play, the company still appears to be toeing that same line.

The limited scope of coverage and lifecycle for the microGEO satellites leaves Anuvu still very much a lessee in the market, even with a couple owned payloads. And, again, the flexibility for the company to mix-and-match capacity from different providers is a big part of the value proposition Anuvu pitches to airline customers.

More on Anuvu’s microGEO evolution:

- Astranis successfully launches microGEO satellites, including two for Anuvu

- Anuvu updates microGeo timeline, adds fun satellite names

- Astranis Arcturus microGEO failure pushes back on Anuvu’s schedule

- Anuvu taps Telesat for MicroGEO gateways

- Anuvu adds $50 million for MicroGEO connectivity growth

- Anuvu bets big on little satellites for in-flight connectivity

A favor to ask while you're here...

Did you enjoy the content? Or learn something useful? Or generally just think this is the type of story you'd like to see more of? Consider supporting the site through a donation (any amount helps). It helps keep me independent and avoiding the credit card schlock.

Leave a Reply