Gogo will acquire Satcom Direct, bringing significant consolidation to the business aviation inflight connectivity market. The deal aims to combine the two largest players in the BizAv market, ultimately creating a global leader across both satellite and terrestrial connectivity options.

This transaction accelerates our growth strategies of expanding our total addressable market to include the 14,000 business aircraft outside North America, and delivering solutions that meet the needs of every segment of the BA market. – Oakleigh Thorne, Gogo Chairman and CEO

Under the terms of the agreement, Satcom Direct will receive $375 million in cash and five million shares of Gogo stock at closing. The deal also allows for up to an additional $225 million in payments based on retaining and growing broadband customers above certain performance thresholds through 2028.

Building Bigger for BizAv Connectivity

Satcom Direct is the leading provider of GEO-based satellite services for the business aviation community, with a strong sales and delivery network focused outside the United States. That provides two avenues for Gogo to grow.

Gogo’s plans have the company betting big on its Galileo LEO-based solution (using OneWeb satellite capacity). That offering opens up the global market, and buying out the main competitor rather than fighting them seems like a strong play.

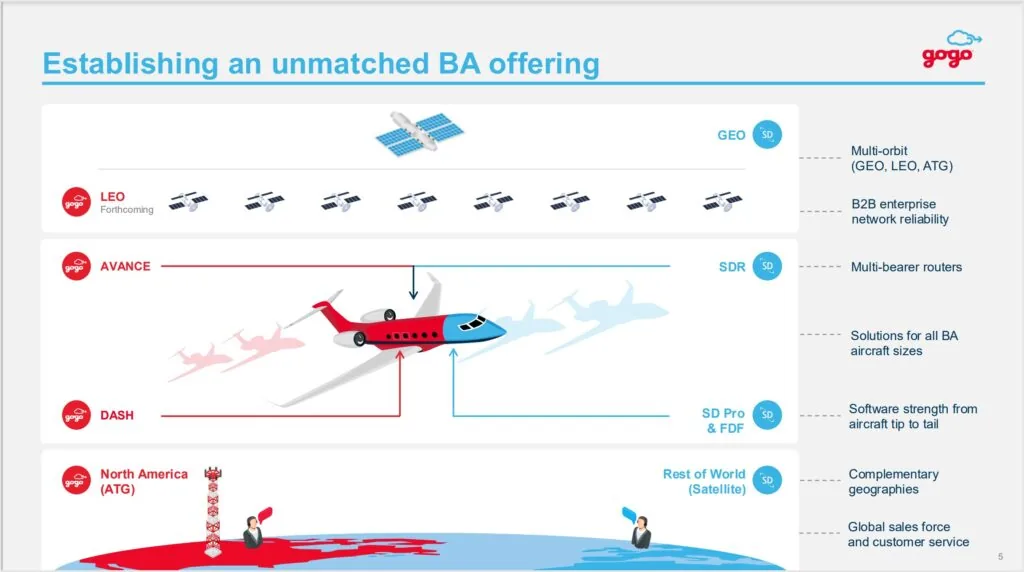

With the Satcom Direct offering integrated into Gogo’s portfolio, the company aims to deliver a multi-orbit offering. This would combine Satcom Direct’s GEO services with Gogo’s LEO capacity, offering high performance and redundancy with the ability to route traffic over the most cost-effective link at any time.

Read more: Stellar Blu, Fargo Jet Center team for special missions connectivity

Satcom Direct’s existing offering already includes a multi-bearer router, similar to Gogo’s AVANCE solution. This allows multiple network links to be easily and efficiently combined on an aircraft.

While there are potentially technical limits around the Galileo antenna terminal’s ability to deliver a strong GEO link, Satcom Direct has its own line of PlaneSimple terminals (including ESAs) that could deliver the desired services. The ability to mix-and-match networks is a strong play, especially for customers with critical communications needs.

Military and Government Growth Opportunities

While some business jet owners might think their IFC needs are critical, the special missions operations from military and government customers come with strict performance requirements. Satcom Direct already sees about 20% of its revenue from this segment, and adding the multi-orbit option creates a significant opportunity for it to grow.

Gogo CEO Oakleigh Thorne called out that growth potential in the statement announcing the deal, “This transaction also uniquely positions us to sell our Galileo LEO solution integrated into Satcom Direct’s GEO and L-band offerings as part of a multi-band, multi-orbit solution for the fast-growing military/government mobility market.”

It is almost certainly not a coincidence that Gilat cited this market as well in its justification for acquiring Stellar Blu and its terminal offering. Other hardware providers are also angling towards multi-orbit solutions, meaning the combined Gogo/Satcom Direct will have plenty of options for terminals as it looks to grow in the space.

A favor to ask while you're here...

Did you enjoy the content? Or learn something useful? Or generally just think this is the type of story you'd like to see more of? Consider supporting the site through a donation (any amount helps). It helps keep me independent and avoiding the credit card schlock.

Leave a Reply