Just months after emerging from its bankruptcy reorganization Spirit Airlines was back in court over the weekend, once again seeking the protections of the US Bankruptcy Code as it works to find a profitable operating model. Unlike the prior filing, this one was rather more rushed, with no pre-planned collection of funding partners.

It also, per the court filings, appears to be almost entirely tied to the risk of losing 73 leased aircraft (and potentially paying penalties associated with those lease terminations) from AerCap.

The initial filing on Friday offered only the basic details. On Sunday, however, more details emerged in the form of the CFO’s declaration in support of the claim. And compared to the prior Declaration, this one presents a more challenging scenario for the carrier.

The 2025 Declaration notes that business travel recovery remains impaired, forcing legacy carriers to push more of their inventory into the Basic Economy market a segment that competes more aggressively with airlines like Spirit:

[T]he fact that the large airlines have for several years expanded their focus to Spirit’s targeted consumers—and are also co-opting Spirit’s “trademarked” and industry-disruptive approach of low-cost and unbundled airfares—has made external pressures even more acute.

That’s not entirely new, though the hoped-for recovery in 2025 failed to materialize, largely blamed on economic uncertainty. This was, according to Spirit, exacerbated by Southwest Airlines’ product shift:

[I]n 2025 Southwest Airlines, the largest US carrier in terms of available domestic seats, announced a significant transformation to its business model seeking to address its languishing financial performance compared to the three large US network carriers (American, Delta and United). These changes initially met with some resistance among Southwest’s customer base, and Southwest responded by slashing pricing on domestic routes, affecting the entire industry.

Fixing the Fleet

Those issues were challenging, but theoretically manageable under the prior reorganization. A key problem came in the form of a notice of default from aircraft lessor AerCap on 25 August 2025.

That notice indicated that AerCap considered Spirit in default on its contracts for 37 existing aircraft and 36 scheduled for delivery in 2027 and 2028. While Spirit disagrees with AerCap’s position on the claim, it was required to disclose the notice on Friday. With that filing Spirit feared a cascade of suppliers cancelling contracts:

Concerned that the disclosure of these purported default notices by its biggest lessor could prompt other actions from other counterparties, including other aircraft lessors, Spirit concluded that it had no choice but to quickly seek the protections of chapter 11.

The company asserts it may pursue legal claims against AerCap for increased costs associated with the default claim,

Also on the fleet front, Spirit announced a plan in October 2024 to sell 23 aircraft to GA Telesis. Only three or four were delivered*, however, before the bankruptcy proceedings got in the way. That deal is now dead and the company continues to have “discussions with parties regarding a potential transaction for these aircraft.”

Spirit further notes that 38 of its A320neo and A321neo aircraft are currently grounded owing to the Pratt & Whitney GTF powdered metal engine issues. While it secured some compensation from the manufacturer, it insists the amount is insufficient to fully cover the carrying costs of the grounded planes.

And so now Spirit will use the new Chapter 11 cycle to more dramatically refactor its operations.

The carrier plans a network redesign, “to focus its flying on key markets to provide more destinations, frequencies and enhanced connectivity in certain of its focus cities, while simultaneously reducing its presence in certain other cities.” This includes an effort to “rightsize its fleet to match capacity with profitable demand.”

Spirit expects this ultimately will “significantly shrink Spirit’s overall fleet” leading to hundreds of millions of dollars in annual OpEx savings.

Of course, Spirit wants to choose which planes are returned rather than letting AerCap do so. This is driven, in part, by Spirit’s belief a number of its aircraft are currently running with “ownership costs at or below market levels.” It wants to keep those while “shedding associated embedded maintenance and return costs.”

Similarly, the new deliveries won’t need to be immediately grounded for engine repair, nor do they require other maintenance expense.

This likely will include terminating leases on some of the grounded aircraft with pending engine work, using the Chapter 11 framework to do so.

Significant Staffing Shift

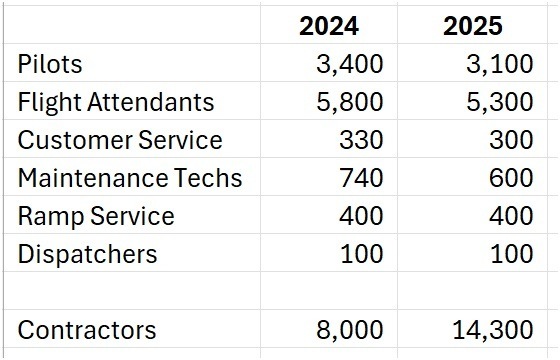

Another interesting bit in the two declarations is the shift in staffing numbers. Spirit has 1,600 fewer direct employees per the 2025 filing than it did at the 2024 bankruptcy. That’s the sort of shrinkage one would expect to see with the initial reorg and cutting of service.

But it also has 6,300 more contractors. That’s a significant change in the other direction.

A New Business Model

In the 2024 declaration Spirit describes itself as “a leading ultra low-cost carrier (a “ULCC”) committed to delivering value to its guests by offering an enhanced travel experience with flexible, affordable options.” In the 2025 version Spirit is “a leading value airline committed to delivering value to its guests by offering an enhanced travel experience with flexible, affordable options.”

Maybe that matters; maybe it does not. But Spirit is fully invested in the rebranding of its offerings. It also notes that passengers seem pleased with the changes, with net promoter scores “higher for 2025 than any previous year, a result of the Company’s investment in building a friendlier and more flexible experience.”

Further, while the classification shifts, Spirit still believes it is a stabilizing agent in the market. And it expects to remain such, so long as it is still flying:

Once the optimization of Spirit’s network, fleet, cost structure and customer offerings is completed, and given cost advantages that almost no other industry participant can match, Spirit will once again be the disruptive maverick that has long challenged—and changed—the U.S. aviation industry, not only providing reliable service to its own customers at very attractive prices but also disciplining domestic prices on all carriers, thereby saving American consumers hundreds of millions per year – whether they fly Spirit or not.

Wi-Fi Impact

As part of the prior re-org and product shuffle Spirit began offering complimentary inflight internet to passengers in the premium seats on board. That came with an increased cost, sufficient to be called out in the company’s Q2 earnings release just a few weeks ago. That also mostly translated to increased revenue for Thales Inflyt, the provider of Spirit’s IFC system.

With the fleet being slashed, however, that spike in connectivity expense/revenue appears to be short-lived, or at least retreating.

*The company states at one point in the filing that 19 aircraft are unavailable on account of being held for sale. In a separate chart, however, it says 20 are being held. Either way, that large chunk of cash never showed up.

A favor to ask while you're here...

Did you enjoy the content? Or learn something useful? Or generally just think this is the type of story you'd like to see more of? Consider supporting the site through a donation (any amount helps). It helps keep me independent and avoiding the credit card schlock.

Leave a Reply