Gogo beat analyst revenue expectations in Q1 2025, and also beat the expected timeline for certification of the larger FDX antenna for its upcoming Gogo Galileo low earth orbit satellite-based connectivity solution.

The company reported revenue of $230.4 million, up 4% YoY from the combined pre-merger revenues of Gogo and Satcom Direct. That revenue split $129 million from the legacy SD business (+9.97% YoY) and $101.3 million from the legacy Gogo side (-2.88%).

That split was driven mostly by growth in installations – predominantly line-fit – of GEO satellite services in the BizAv segment. Those contract are typically longer term rather than the month-to-month Gogo gets on its Air-to-Ground services. The company also shares that the average revenue per aircraft (ARPU) on GEO is “holding up much, much better” than on the ATG side of the business. At the same time, CEO Chris Moore acknowledged the “continued pressure on that piece” of the business, as competition continues to grow.

The company also reported seemingly strong numbers on the equipment sales side of the operation, though it also shares that margins were relatively low, as equipment sales are used to “drive this recurring high margin service revenue.” Gogo also reiterated that it expects to sell the Galileo hardware at close to cost. Among other things this helps to suss out some details of the contract with Hughes Networks, the primary (but not only) hardware supplier for the Galileo program.

With the 10-Q filing later on Friday we learned just how low those margins are trending. In Q1 2024 Gogo sold $22.6M in equipment with a 30% margin. In 2025 total equipment revenue was $31.7M. The legacy Gogo side of the business was $21.8M of that, however, meaning it dropped YoY. More critically, the cost for that equipment was significantly higher, leading to a margin of just 8%. Hardware margins on the SD side were even lower, just under 6%.

Gogo points to the recurring service revenue as higher margin, and a stronger contributor to overall company profitability. But that margin, too, is expected to shrink as the satellite offerings become a larger part of the business.

For the FDX terminal the company announced on Wednesday it reached the PMA milestone. It will now progress with STC programs for that model, as well as the HDX.

Also of note, much of the hardware delivered to date is for STC programs, not for customer installation. Moore shared that of the 59 HDX terminals shipped so far, 42 are for certifications. Just eight of the unites shipped in Q1 were for customer installations. That will accelerate, of course, as the STCs are finished. But reading too much into the early numbers might skew expectations. This is a large part of why the company continues to project a service revenue ramp at the end of the year into early 2026, rather than sooner.

Growth in Government/Military

The government and military segment shows strong resilience for Gogo, with upside across multiple fronts.

In the domestic market the pLEO total projected spend continues to rise, and Gogo expects it will grab a solid share of that market. It notes that the LEO solution can be used not only as a single link connection, but also to augment other connectivity services on board, a requirement for government contracts.

Outside the US, the GovMil segment sees “increased demand overseas as non-US government disengage from their reliance on the DOD for military support and ramp up their investments in defensive spending, including commercial communication systems.” Put another way, as the US government recedes on the global defense stage other parties are stepping up, and Gogo plans to capture a solid chunk of that revenue.

ATG Stalls, Maybe Shrinks

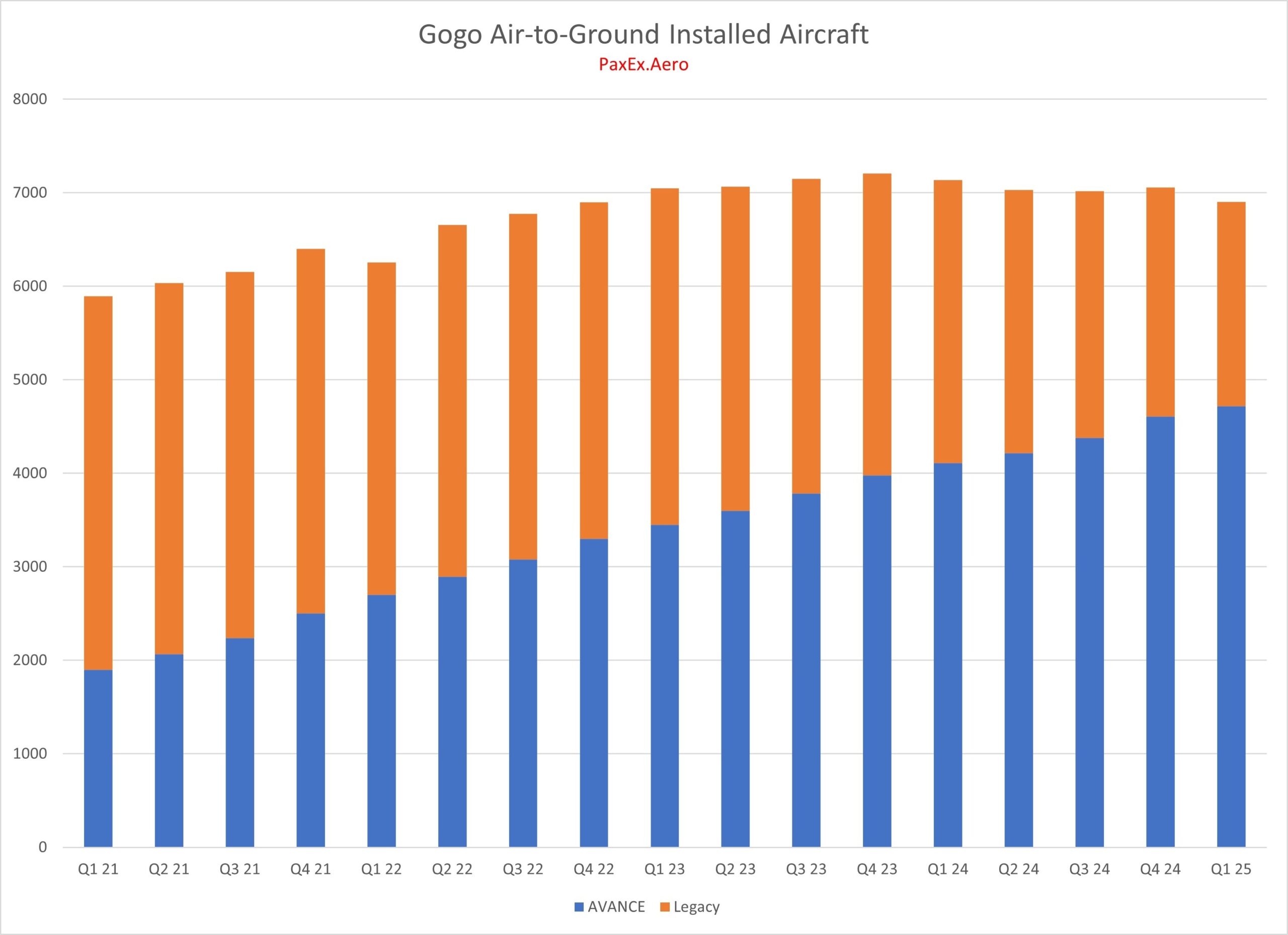

Numbers in Gogo’s ATG program are stalling. ARPU held flat YoY while the total number of aircraft online (AOL) dropped 3%. The drop comes against a backdrop of growing AVANCE systems installed.

Gogo says Q1 typically sees a drop in active aircraft, owing to owners taking a break from travel for maintenance work on their planes. Recent history bears that out, with drops in 2022 and 2024. In 2022 the growth recovered, while in 2024 it did not.

For 2025 Moore is optimistic, sharing that the company has “really good market intelligence data on why customers are suspending or leaving the network.” They believe they know which are defecting to a competitor versus planning to reactivate when the plane returns to service. “It’s pretty well educated, there’s not kind of, you know, guesswork.” That does not necessarily align with the broader trend of shrinking total AOL over the past several quarters. Until the 5G system is really ready we won’t know for sure just how good that market intelligence really is.

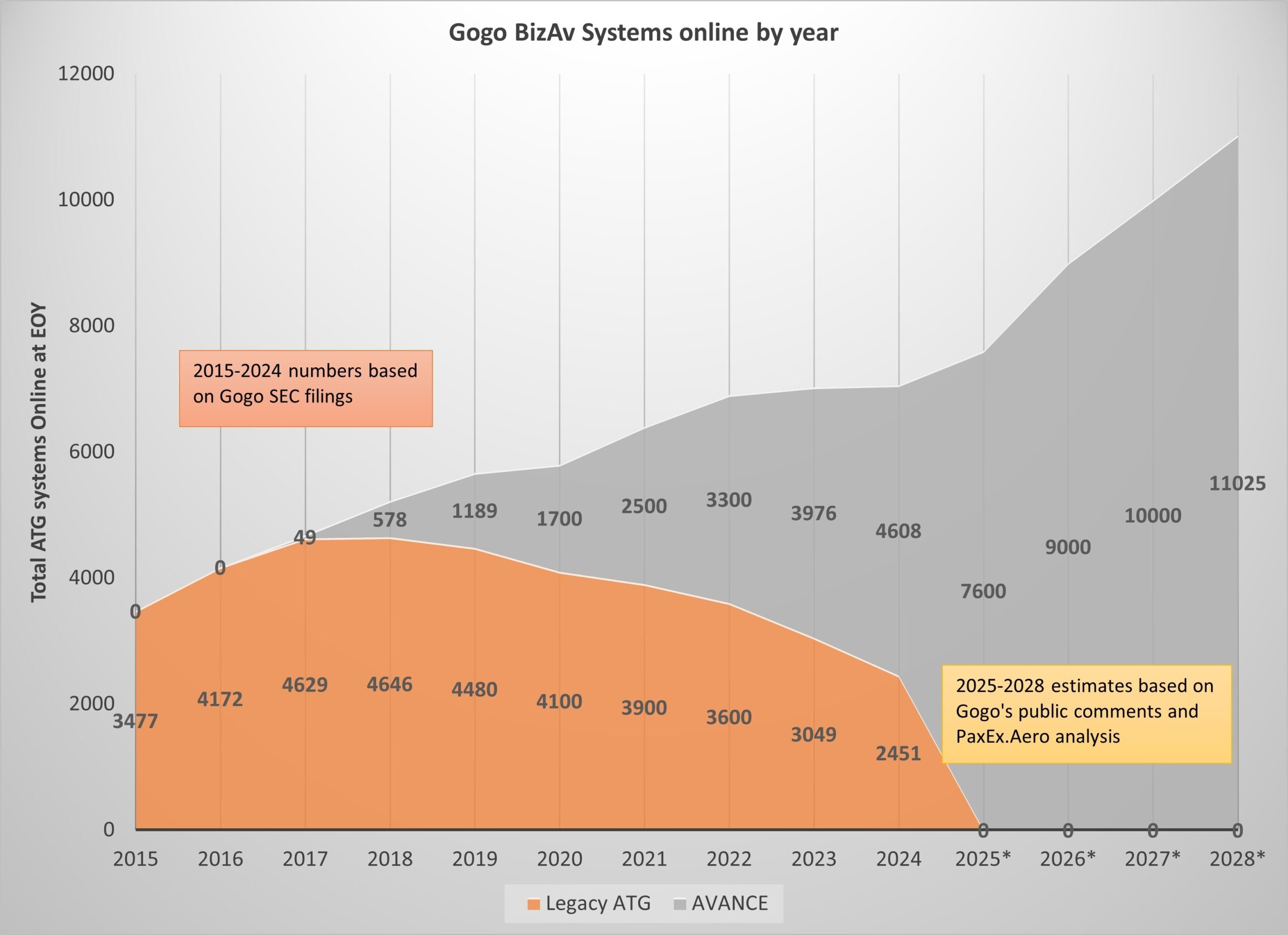

The total numbers also belie Gogo’s earlier estimates about ability to capture market share. In March 2024 the company forecast 14,000 business aviation aircraft would be fitted with broadband by 2028, of which more than 11,000 would fly with Gogo gear.

That estimate included approximately 7,600 flying by the end of 2025. Slips in the 5G and Galileo program certainly impeded that progress, but it does not appear Gogo will hit that mark. At least the company is optimistic again about the 5G chipset, with expectations still of having it in hand later this summer and shipping later this year.

Moore also shared that, while the top line bandwidth numbers from the HDX system are lower than Starlink (and I expect latency will be slightly higher, based on performance of the Intelsat systems on OneWeb satellites), he expects that the total package from Gogo will still prove compelling:

We’ve got customers flying around in Europe, a large fleet operator, and they’re able to do everything they want to do, from teams meetings to streaming movies on the bulkhead. The nice thing with our solution is it’s completely integrated into the cabin management system.

Regarding comparisons to competitive products, HDX is designed to go to 50 Mbps. We’re seeing the product perform within that parameter. The uplink speed is solid. And, really, when you look at the passenger counts on those jets, you know, there’s more than enough capacity.

I think everybody’s gone kind of speed mad. Everybody talks about speed, but nobody talks about the consistency and the capacity capability within flight. So, you know, really what we’re focused on is that, and also having service level agreements that we can back that up with.

Merger Synergy Savings

Finally, the company shares expectations of a 21% headcount reduction due to the merger by the end of Q2 2025, part of the promised financial savings for investors. It will also consolidate SD’s manufacturing into Gogo’s facility in Broomfield, CO. Gogo’s data center will similarly be shifted from leased space in Chicago to SD’s purpose-built, owned facility in Melbourne, FL.

A favor to ask while you're here...

Did you enjoy the content? Or learn something useful? Or generally just think this is the type of story you'd like to see more of? Consider supporting the site through a donation (any amount helps). It helps keep me independent and avoiding the credit card schlock.

Leave a Reply