Launching a new product at an airline is no easy task. Launching one that requires changing the layout of the cabin brings even more risk. Growing premium demand – even in the domestic US market – continues to deliver, however, and Allegiant Extra is no exception.

Indeed, its performance has been a key factor in the company’s revenue since its launch, and the company expects that to continue as the rollout expands.

[Allegiant Extra] has been a phenomenal product. It has been resilient – as we move past that initial wave of bases or routes that you cherry pick, that are likely to be the best – and continues to show great results. That gives us a lot of confidence that [keeping it] is the right the right call.

– Allegiant CCO Drew Wells

Chief Commercial Officer Drew Wells shared during Allegiant’s Q2 2025 earnings call that having the product available yields about a $3/passenger boost to revenue, more than $500 per departure on average. In an industry where margins are slim that $3/passenger means a lot. Also, to be frank, I expected the number to be a little higher.

Wells assures me, however, that my formula needs a few adjustments.

For starters, Allegiant only counts the “Extra” product seats for this metric, not the extra legroom seats near the exit rows, as they don’t include benefits like a free snack and reserved overhead bin space. That means just 21 seats on the MAX and 36 on the A320 are in play. But with Extra pricing at $50+ in most cases, where’s the disconnect?

Wells confirms that about 70-75% of the seats on Extra-equipped planes carry paying passengers. “We tend to do extremely well with all the aisles and windows, as you could assume,” he explains. “And then it comes down to how well we sell the middles on any given flight. That’s kind of gravy when you sell the middles as well.”

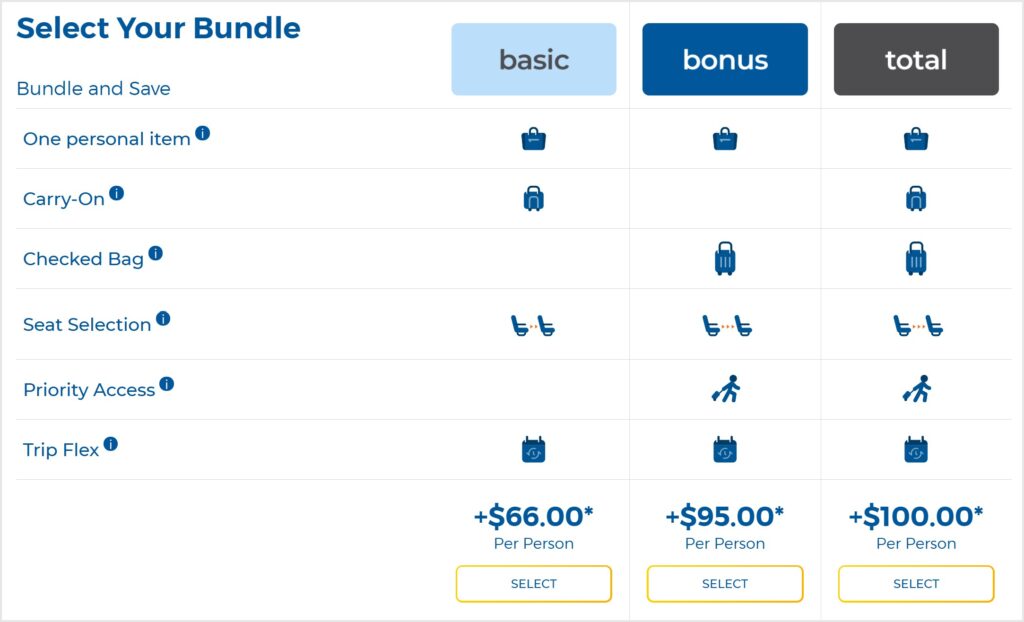

He also shared that “definitively more” of the seats are sold through a fare bundle, including bags and other benefits, rather than as a discrete ancillary choice. That knocks the price down a bit, as the company allocates the bundle pricing across the several benefits offered.

Finally, Allegiant accounts for a (potential) revenue offset from the reduced capacity of the planes. The Extra config requires taking seats out of the A320s (and not installing quite as many in the MAX 8200s).

A growing product

Extra was available on roughly 50% of the airline’s departures at the beginning of 2024. That’s up to around two thirds today. The carrier expects to have it on 70% of flights by the beginning of the year. That shift comes in the form of seven new MAXen expected to join the operation in the second half of the year, as well as four A320s being converted.

The carrier will also remove four A319s from the fleet in that window. Those planes do not have Extra seats on board and will not. The impact of losing a row of seats on the smaller plane puts increased pressure on the offering. “You have fewer seats on the airplane that cost you a little bit more in opportunity cost,” Wells explained.

More on Allegiant Extra seating

- Allegiant goes Extra with increased legroom option

- PaxEx Update: 26 July 2019

- Allegiant goes Extra for legroom on board

- Allegiant plans more Extra on 737 MAX fleet

- Mixed ancillary messages from Allegiant in Q3 results

- Allegiant continues Extra expansion, predicts competitive collapse

- Loyalty, Legroom Drive Value at Allegiant, Sunset for Sunseeker

- Squeezing "Extra" Revenue from Allegiant’s Seats

A favor to ask while you're here...

Did you enjoy the content? Or learn something useful? Or generally just think this is the type of story you'd like to see more of? Consider supporting the site through a donation (any amount helps). It helps keep me independent and avoiding the credit card schlock.

Leave a Reply