The Gogo acquisition of Satcom Direct closed, bringing consolidation to the business aviation connectivity market. Gogo paid $375 million in cash and issued five million shares of Gogo stock to SD ownership at close and could pay up to an additional $225 million tied to realizing performance thresholds over the next four years.

Combining with SD cements our position as the only in-flight connectivity provider able to satisfy the performance and cost needs of every segment of the global BA market. – Oakleigh Thorne, Gogo Executive Chair

Building Bigger for BizAv Connectivity

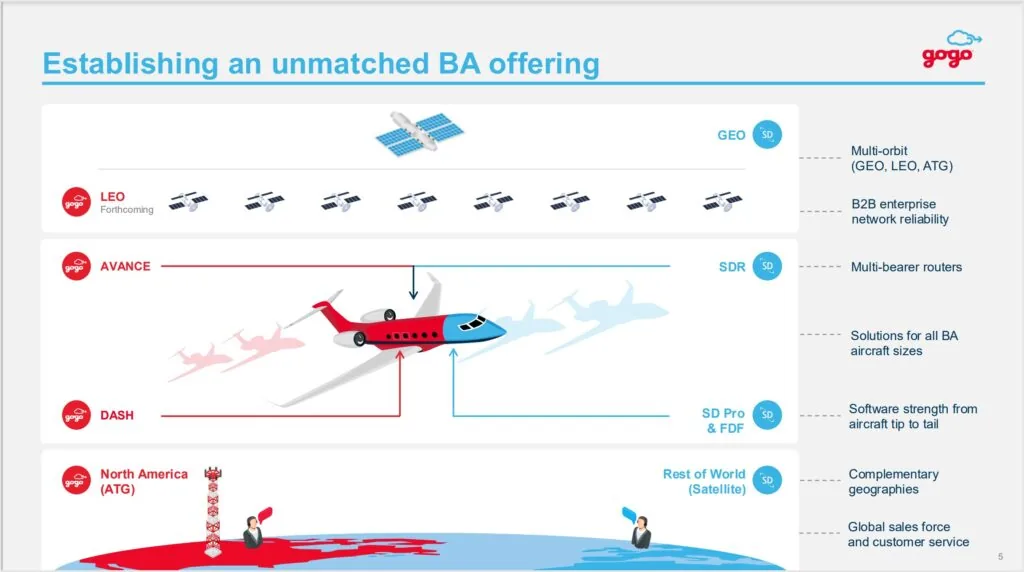

Satcom Direct is the leading provider of GEO-based satellite services for the business aviation community, with a strong sales and delivery network focused outside the United States. That provides two avenues for Gogo to grow.

Gogo’s plans have the company betting big on its Galileo LEO-based solution (using OneWeb satellite capacity). That offering opens up the global market, and buying out the main competitor rather than fighting them seems like a strong play.

With the deal now closed Gogo will focus on three key SD markets for the combined company’s LEO-connected addressable market. They include:

- SD’s 1,300 premium global broadband customers

- More than

12,000 medium and smaller business aircraft outside North America, addressable with SD’s existing international sales team - SD’s strong Military and Government presence where multi-orbit demand, demand for LEO connectivity in combination with SD’s GEO connectivity.

The consolidation also means a likely shift in the BizAv LEO antenna market. Satcom Direct had been partnered with Gilat, QEST, and Stellar Blu (now owned by Gilat) for hardware. Gogo has an exclusive partnership with Hughes Networks for the HDX and FDX hardware. With the business refocused on the Galileo offering that likely leaves the SD partners out, at least in the short term.

Leadership Changes

Gogo President and COO Sergio Aguirre announced his retirement from the company on 15 November, effective 31 December. With the transaction closing other changes are afoot.

Oakleigh Thorne has stepped down from his position as CEO of the company, retaining the role of Executive Chairman. SD President Chris Moore will take over as CEO, bringing significant satellite and telecom experience to the the role.

Zachary Cotner, Chief Financial Officer of SD, will take over as Chief Financial Officer of the combined company, succeeding Jessi Betjemann. Mike Begler, who previously served as Senior Vice President of Gogo Production Operations, has been appointed Executive Vice President, Chief Operating Officer of the combined company.

An SEC filing published Tuesday afternoon suggests the deal finalized on 26 November; the announcement was issued on 4 December.

Additionally, Gogo reiterates that its small-form-factor Galileo HDX LEO service remains on track to begin shipping to customers by the end of 2024, and it expects to launch its large form factor Galileo FDX, and its Gogo 5G network, late in the second quarter of 2025.

A favor to ask while you're here...

Did you enjoy the content? Or learn something useful? Or generally just think this is the type of story you'd like to see more of? Consider supporting the site through a donation (any amount helps). It helps keep me independent and avoiding the credit card schlock.

Leave a Reply