You are now free to pay for checked bags.

Perhaps not quite the smooth phrasing Southwest Airlines is known for with its marketing tag lines, but it is the new reality for the carrier. From 28 May the “Bags Fly Free” policy that has been in place since Southwest launched operations more than 50 years ago will disappear.

The new bag fees will take effect for tickets purchased on or after 28 May 2025.

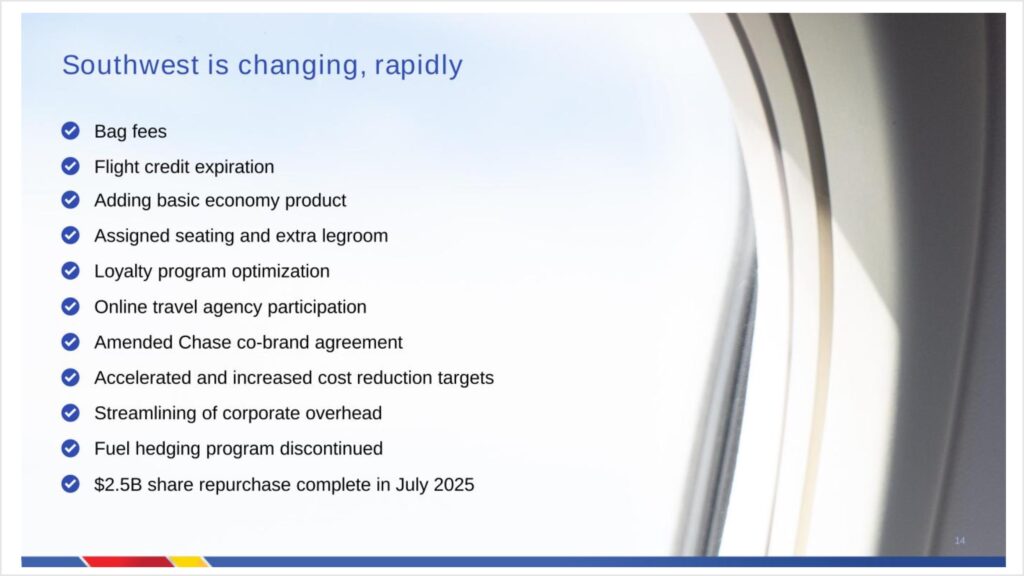

This is the latest in a string of changes over the past year to boost revenue for Southwest. That effort has also led to chipping away at the various differentiators it has held relative to the rest of the industry.

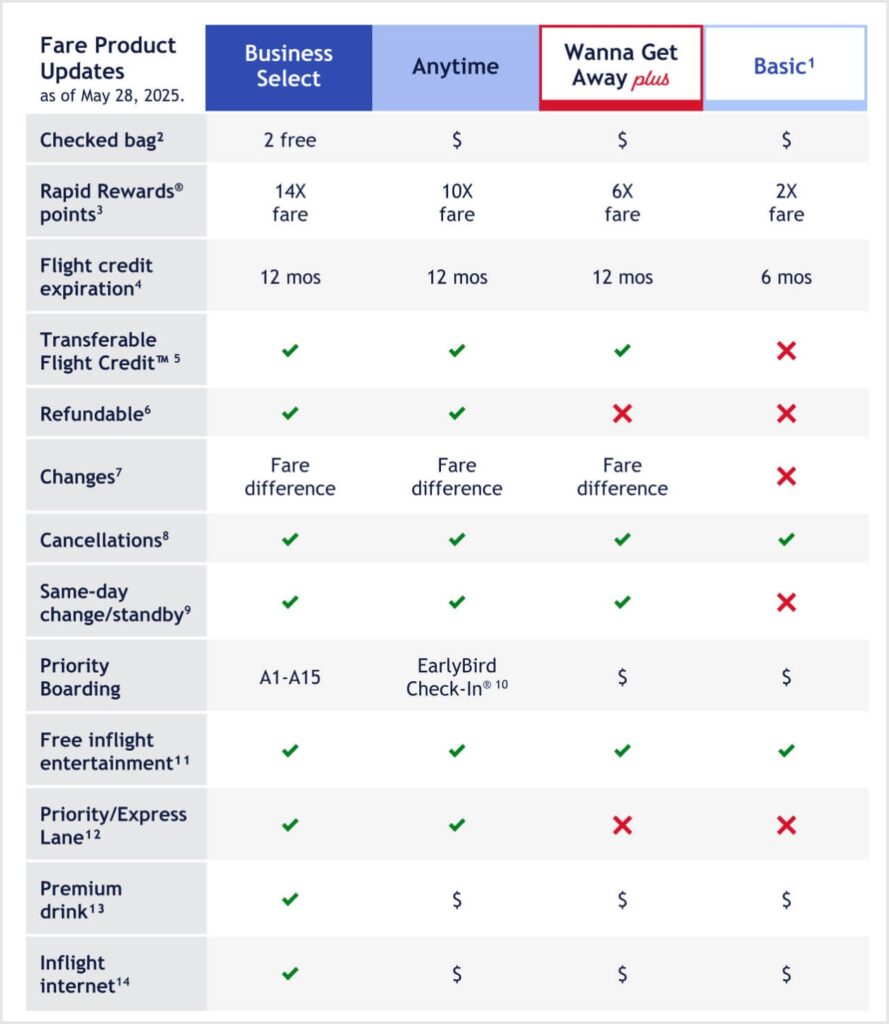

Passengers on Business Select fares will continue to receive two free bags. So will A-List Preferred members. A-List members will receive one bag free, as will Rapid Rewards co-brand credit card holders. In its pitch to investors about the shift Southwest positions it as incentivizing adoption of the co-brand card.

The change is one of several the company highlights for investors today. Among the other changes, fare credits will now only be valid for one year on most fares. The company also plans a Basic Economy fare that, among other things, reduces the fare credit validity to just six months. The new basic economy fare replaces the Wanna Get Away offering.

Earning and redemption rates in the Rapid Rewards program have long varied based on fare family. The carrier now expects to further differentiate those rates with “dynamic optimization…on both low and high demand flights.”

Southwest also is shifting towards more public distribution of its tickets, including deals to appear on metasearch engines and third party sales channels. Previously fares could only be purchased on the company’s website (or call center). That walled garden kept many customers loyal historically. As it offers more opportunities to directly compare prices against other airlines it could bring in more traffic. But it could also see otherwise loyal customers book away, especially as the other “soft” benefits shift.

Southwest will also terminate its fuel hedging program per the investor presentation. That program drove significant profits for much of the company’s history.

Finally, the carrier notes it is accelerating its share buy-back efforts. It now expects to spend $1.5 billion on that in the first half of 2025 rather than taking the full year.

A favor to ask while you're here...

Did you enjoy the content? Or learn something useful? Or generally just think this is the type of story you'd like to see more of? Consider supporting the site through a donation (any amount helps). It helps keep me independent and avoiding the credit card schlock.

Leave a Reply